Understanding how you will finance the purchase of a home is an important part of the process. A mortgage loan officer can help ensure you get pre-approved for a mortgage, which is essential to seeing the homes that pique your interest. Pre-approval provides invaluable insight into the current mortgage market. The mortgage loan officer is a valuable resource in learning more about mortgage terms, payments, and other factors to consider when making this significant investment.

What’s a mortgage pre-approval?

Getting mortgage pre-approval is an important step when you are in the home-buying process, as it helps to determine exactly what type of mortgage might be right for you. During the pre-approval process, a lender will review your income, employment, credit, and assets to determine what mortgage offers you qualify for. They can also determine the estimated monthly payment and closing costs you can expect. Knowing this information before jumping in can help significantly narrow your prospective homes so that you don’t waste time looking at properties outside your price range.

What’s needed for pre-approval

- Most recent two years of W2s.

- Most recent 30 days of pay stubs.

- Most recent two months of asset statements (all pages) – checking, savings, retirement, investment, etc.

- Most recent mortgage statement and insurance bill – only if you currently own real estate.

- Your Driver’s License.

It’s important to note if you areself-employed, you will also need the following information.

- Most recent two years of filed personal tax returns – only needed if self-employed or have income from a non-traditional source (i.e., interest, dividends, rental property, etc.)

- Most recent two years of filed business tax returns.

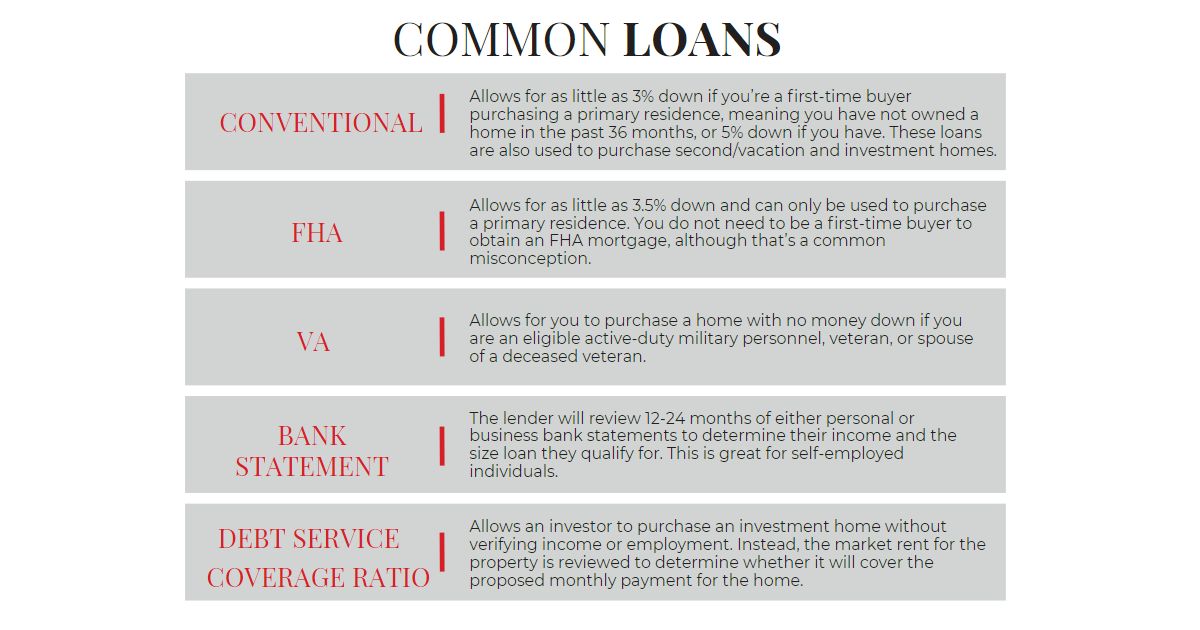

Most common types of loans:

We’d love the opportunity to help you find your dream home! Give us a call or email to see how we can make your home buying dreams a reality!